- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

On September 13, 2023, European Commission President Ursula von der Leyen announced the launch of an anti-subsidy investigation into Chinese electric vehicles. Notably, this is the first global anti-subsidy investigation targeting Chinas automotive industry. It resembles a storm, especially for Chinese EV manufacturers.

What kind of game is this exactly?

For the EU, anti-subsidy investigations are not a new game. But for Chinas automotive industry, this is a new challenge. Previously, the EU launched multiple trade remedy investigations against China, mainly targeting traditional manufacturing industries like steel, textiles, and furniture. This time, targeting the automotive industry directly is an unexpected edge ball.

What are the EUs anti-subsidy investigation rules?

The EU has a specialized set of anti-subsidy investigation rules, whose essence is: if products from a country receive subsidies that cause harm to EU domestic industries, the EU has the right to investigate and may impose countervailing duties. It sounds like an advanced board game with complex strategies and rules. But actually, its a form of protectionism. Dont worry, well analyze these rules step by step.

(1) What is an anti-subsidy investigation?

First, we need to clarify that anti-subsidy investigations are conducted by the EU on certain products from non-EU countries. Their purpose is to determine whether these products have received subsidies from the exporting country and whether such subsidies have caused damage to the EUs domestic industry.

(2) Legal basis: EU Anti-Subsidy Regulation

EU anti-subsidy investigations are conducted based on the Regulation on Protection Against Subsidized Imports from Countries Not Members of the European Union (also known as the EU Anti-Subsidy Regulation). This regulations basic principles originate from the WTO Agreement on Subsidies and Countervailing Measures (referred to as SCM Agreement).

(3) Who is the referee of the investigation?

The competent authority for conducting anti-subsidy investigations is the European Commission. But when it comes to final decision-making, it depends on the stance of the EU Council of Ministers.

(4) How to determine the existence of subsidies?

The definition of subsidies is broad, encompassing any form of financial contribution provided by the government or public bodies of the exporting country. This includes, but is not limited to, low-interest loans, electricity subsidies, tax incentives, etc. The key here is that these contributions must provide actual benefits to the recipients.

(5) Specificity of subsidies: De jure specificity and de facto specificity

Only specific subsidies are considered problematic. Specificity here includes two aspects: de jure specificity and de facto specificity based on actual operations. For example, if a subsidy is only available to a specific industry or region, this is de jure specificity. De facto specificity is more complex and requires judgment based on specific cases.

(6) How to determine whether damage has been caused?

Determining whether damage has been caused is a complex process that requires a comprehensive assessment from multiple aspects, including the existence of subsidies, the specificity of subsidies, and whether the EU industry has suffered material damage.

(7) EU interest test

Finally, theres a very important step called the EU interest test. This ensures that even if subsidies are confirmed and harm is established, the EU must verify that imposing countervailing duties wont harm overall EU economic and industrial interests.

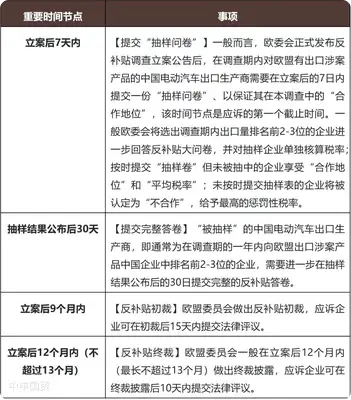

Procedurally, EU anti-subsidy investigations specify a particular investigation period, which is clearly stated in the initiation notice. Typically, the investigation period is one year. Once the investigation begins, the main key timelines are as follows:

How to weather this storm?

Assess existing business and product conditions, actively respond to litigation

If named in the investigation, the best approach is to actively respond and provide truthful, complete documentation to prove your innocence.

Coordinate among enterprises and cooperate fully

In this battle, unity is strength. Enterprises should coordinate and respond collectively.

Select a professional team to handle the investigation

Since its a battle, a strong army is needed. Selecting a professional team is key to responding to investigations.

Adjust future business plans based on the ruling results

Regardless of the investigations outcome, future business plans must be adjusted to ensure the steady development of the enterprise.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912