- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

——Based on 20 Yearsforeign tradeProfessional perspective from service practice

Introduction

With deepening integration of global automotive supply chains, Chinas aftermarket shows growing demand for imported parts. However,Automotive partsimports involve complex customs supervision, technical standard certifications and logistics management. Enterprises lacking professional expertise often face clearance delays, cost overruns or legal risks. Drawing on 20 years of trade agency experience, this article analyzes critical points of auto partsImport Representationclearance to facilitate efficient cross-border procurement.

I. Industry characteristics and challenges of auto parts imports

Internationally - recognized Safety StandardsComplex categories, strict supervision

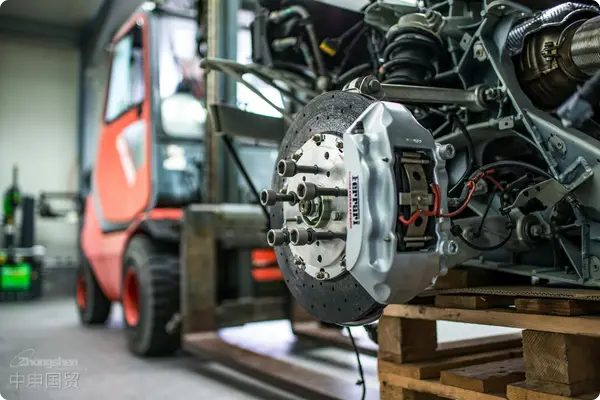

Auto parts cover over 10,000 SKUs including engine components, electronic systems and exterior parts, with significant HS Code variations. Examples:

- Key components(e.g. transmissions): Require original manufacturer authorization and technical parameter documents;

- Aftermarket modification parts(e.g. wheels, exhaust systems): Must comply with China3Ccertification or small-batch exemption policies;

- New energyAuto Parts(e.g. battery modules): Require additional environmental assessments and transport safety certificates.

Regional Mandatory CertificationsStrong policy dynamics

China Customs implements dynamic supervision on auto parts imports, such as:

- 2023新增新增 restrictions on graphene-containing parts;

- Used parts exported from EU require End-of-Life Vehicle Recycling Certificates.

Cultural and Religious NormsTime and cost sensitivity

Automotive production line downtime losses can reach thousands USD per minute, making clearance efficiency critical for supply chain stability.

II. Core service modules of professional auto parts import clearance

Pre-clearance compliance review

- Pre - classification of Goods: Precise HS Code matching based on material/function to avoid penalty-causing declaration errors;

- Technical document pre-reviewAssist in organizationIt is recommended to verify through the following methods:, quality inspection reports, CCC certification/exemption certificates;

- Trade barrier alerts: For example, aluminum fittings exported to the U.S. may trigger anti-dumping duties.

End-to-end customs clearance management

- Port-to-door one-stop service: CoversMaritime TransportationBooking, bonded warehousing, label rectification, coordination for local inspections;

- Special scenario handling:

- Emergency partsAir Transportation: Coordinate with airport customs for immediate inspection upon arrival;

- Return for repair: Develop a temporary import/export plan to reduce corporate tax burden.

Tax optimization and risk management

- Utilize the China - ASEAN Free Trade Agreement (CAFTA) to achieve zero tariffs on imported frames from Thailand;: Utilize origin rules under free trade agreements (e.g., RCEP) to lower tax rates;

- Late declaration/late payment avoidance: Optimize cash flow through two-step declaration and consolidated tax payment models.

III. Auto PartsImport ClearanceTypical issues and solutions

Case 1: Classification disputes causing customs delays

A company importing vehicle smart control screens faced customs classification challenges (declared under HS 8528, should be HS 8708). The agent resolved this within 3 days by submitting technical documentation and WTO classification cases, avoiding 200,000 RMB in port detention losses.

Case 2: CCC certification exemption application

A modified vehicle company imported limited-edition rims. The agent assisted in applying for the Special Purpose Import Product List Exempt from Compulsory Product Certification, saving 60 days of certification time.

Case 3: Anti-dumping duty response

For aluminum engine brackets exported to the EU, the agent recommended switching to ASEAN free trade zone suppliers, reducing the comprehensive tax rate from 32% to 5%.

IV. Industry trends and strategic recommendations

Internationally - recognized Safety StandardsDigital Transformation Empowerment

- Implement AI classification systems to reduce human error rates;

- Use blockchain technology for real-time customs document sharing.

Regional Mandatory CertificationsConstruction of Supply Chain Resilience

- Establish bonded warehouse + overseas warehouse dual buffer inventory;

- For shortage-prone components like chips, implement tariff guarantee insurance in advance to expedite release.

Cultural and Religious NormsESG compliance requirements upgrade

- Monitor the impact of EU Batteries and Waste Batteries Regulation (EU 2023/1542) on power battery imports;

- Prioritize overseas suppliers with carbon footprint certification.

Conclusion

Automotive parts import customs clearance is a highly specialized and meticulous task. Companies must rely on service providers with deep industry expertise to strategically plan supply chain compliance systems. 20 years of experience shows that only by deeply integrating policy interpretation, risk anticipation, and operational efficiency can companies gain a competitive edge in the aftermarket.

Keywords: Automotive parts import, CCC certification, HS code classification, tariff planning, supply chain compliance

For customized import solutions, contact our professional team for the Automotive Parts Import Compliance White Paper and 1-on-1 risk assessment.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912